BDL circular: poorly designed policies are no longer acceptable; a comprehensive reform package is needed immediately

Kulluna Irada welcomes efforts aimed at alleviating the burden of small depositors. However, we express our concern over BDL’s latest circular, which comes as a piecemeal measure outside of a comprehensive restructuring plan to be adopted by government and issued through appropriate legislation. This circular points to the beginning of a campaign towards the Lirafication of dollar accounts, starting with the smallest accounts, and with an unpegging of the national currency through the development of multiple FX rates. Such drastic moves, in the absence of a holistic strategy and transparent framework, are an unacceptable continuation of years of financial and monetary mismanagement.

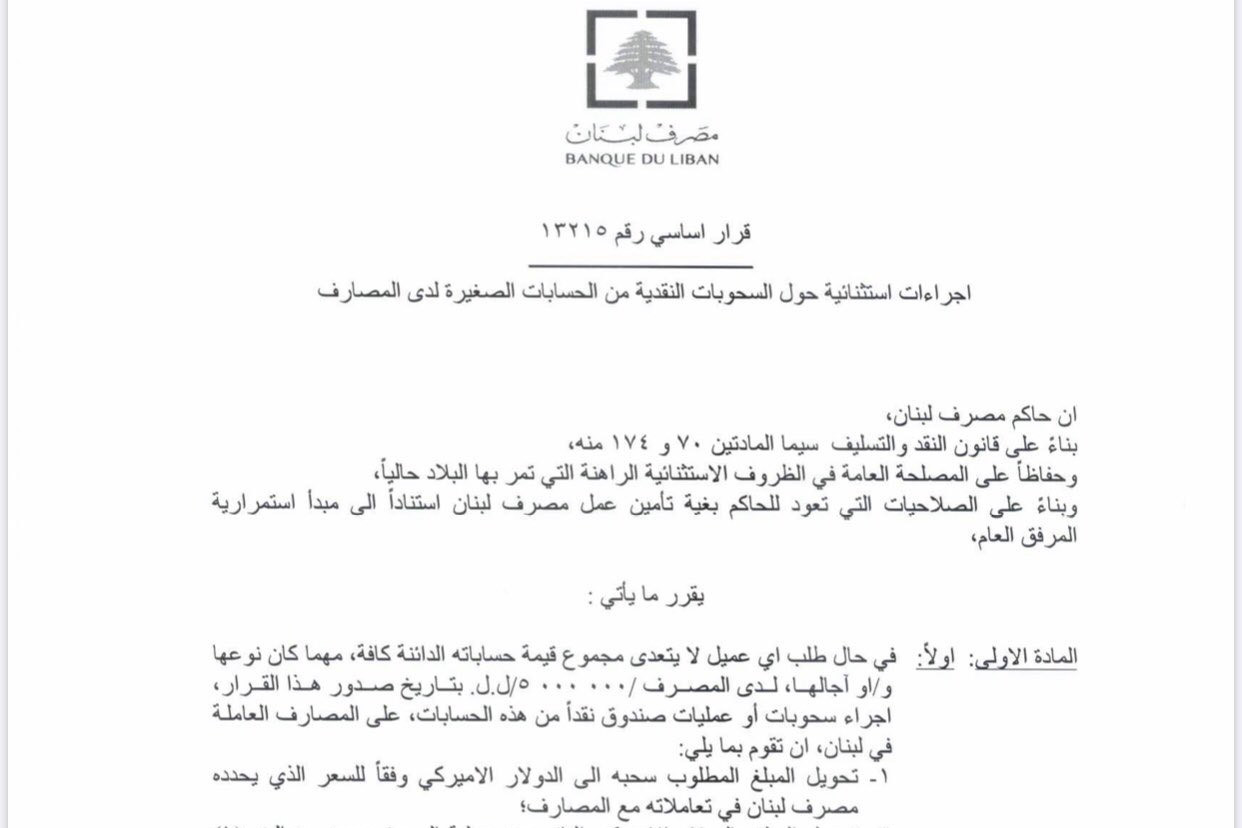

Circular 148 aims at releasing around 800 million dollars owed to small depositors, in an attempt by BDL to manage the monetary environment following government’s failure to enact a Capital Control Law - which should have been the first immediate measure of a rescue plan. Once again, BDL is acting as a sole decision-making entity on decisive economic, financial and social matters, which is not only an overstep of its mandate, but also epitomizes the very worrying deficiencies of the executive and legislative powers. Reports of high-level political interference in this decision are equally worrying and condemnable.

The measure itself does not meet the urgency of the financial situation in the country and should be rapidly complemented by a capital control law that addresses the circular’s shortcomings, followed by a multi-pillared rescue plan. Indeed, what is needed is a comprehensive reform package that targets all aspects of a restructuring of the banking sector, the central bank and public finances, as to ensure proper transparency, equity and accountability, and reboot indispensable liquidity injections in the economy.

From a legal perspective, the circular represents an unorthodox means of protecting Lebanese banks from failure and is infringing on existing laws and jurisdictions. This is yet another measure aimed at managing the banking sector crisis while seeking to circumvent or at best avoid falling under the scope of applicable laws on cessation of payment by a bank. In normal times, when a bank is in a situation of cessation of payment, BDL must refer it to the Special Banking Tribunal in order to launch the appropriate legal proceedings. And BDL remains today under this obligation, until new laws are adopted to restructure the banking sector as whole. Any restructuring measures should therefore fall under a clear rationale and comprehensive restructuring plan presented with the needed draft laws. It should also be noted that the Code of Money and Credit cannot be safely interpreted as allowing BDL to breach the principal of equal treatment of depositors.

The measure is arbitrary, inequitable, and lacking in quantitative indicators

The measure has been presented as an attempt to help small depositors access their money, by providing them with much needed liquidity at a time of crisis. However, the arbitrary nature of the cut-off points for the bands of accounts that qualify (3,000 USD or 5,000,000 LL) is indicative of a cherry-picking policymaking process. In this effect, an account containing $3,000 is worth more, in net market value, than one containing $3,001.

A more rational and equitable policy to avoid these discrepancies would have been to set a certain bracket threshold limit with a specific cut-off point. This would have allowed a larger base of depositors access to much needed liquidity in this time of crisis, noting that a significant proportion of the 87% of depositors who have less than 75 Million LBP or 50,000 USD in bank deposits would not benefit from this circular.

Regardless, any such decision on the targeted brackets should be based on clear, and published, economic reasoning based on quantitative data, and more importantly, as part of a comprehensive financial reform package rather than BDL-imposed piecemeal measures.

The measure gives some breathing space to small depositors, but not without a price

The decision is presented as benefiting small depositors, but the reality is more obscure: while it does provide the intended 1.7 million depositors with access to liquidity, it does not account for the subsequent effect of further Lira devaluation and increased inflation caused by this mechanism, since BDL will be required to raise the LBP money supply to cover for these operations, at an estimated cost of one billion dollars in its borrowed liquidity. The requirement to pay off all loans and have the $3,000/ LL 5,000,000 bracket as a net [Deposits - Loans] figure, rather than referring to the current value of deposits, goes against the pre-negotiated rights of the client and will decrease the number of beneficiaries of this measure – thus unfairly depriving those small depositors of much needed access to their deposits.

On the other hand, the measure allows banks to clear their balance sheet of a large number of accounts and improve their retail portfolios. While this will lead to a much-needed ease on pressures that have been building over the past few months on over-the-counter operations, it risks increasing the number of individuals who are not part of the banking sector at a time where the country should be pushing for more, rather than less, financial inclusion.

The lack of clarity on the exchange rate platform allows for significant manipulations

The language of the circular is formulated in a way that may allow for loopholes and manipulations in the application and implementation of the circular. The circular allows each bank to set the exchange rate on a daily basis, without any reference or detailed explanatory clauses relating to the newly created online foreign exchange platform. The creation of an official and centralized exchange rate platform is a unique opportunity to prevent market manipulation and abusive markups in the foreign exchange transactions taking place in the free market. We suggest that a daily “fixing” price be placed to reflect free market transactions and allow for an official reference rate. However, this platform must have a clear and transparent mechanism allowing all bids and offers channeled through authorized intermediaries to be freely taken into account, without any attempt to put limits on prices or volumes. Trying to artificially limit prices increases or decreases would lead to making the platform useless and push real transactions to take place in parallel markets instead.

Improvised measures taken by BDL are becoming an unacceptable trend; a comprehensive reform package is needed immediately.

.jpg)