The August 4th explosion at Beirut’s port presented another blow to the oil and gas sector in Lebanon. In addition to the fact that Total’s supply-base at the port was heavily damaged, the explosion itself unfortunately further demonstrated the blatant evidence of the poor institutional governance and lack of capacity that the Lebanese State is ailing from.

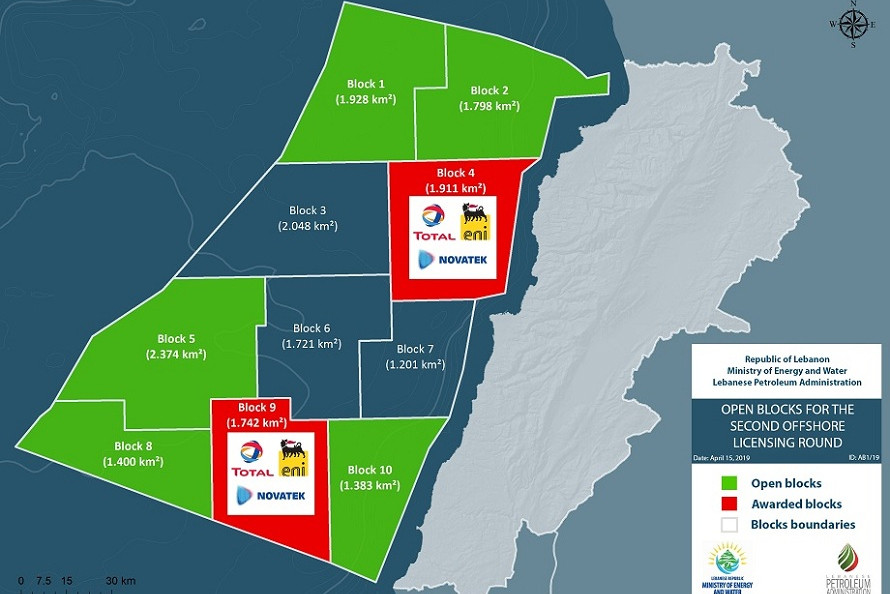

The final damage assessment report is yet to be completed by Total and presented to the LPA, however it is clear that the supply base that provides logistical support to the offshore exploration activity has been severely damaged. Equipment, pipelines and other supplies needed to continue and complete the first exploratory period were stored in warehouses close to the ill-fated warehouse number 12. The minimum work commitment agreed upon between the Lebanese government and the Consortium and led by Total includes drilling 2 wells by no later than May, 2021 (one in block 4 and another in block 9).

Drilling of the first well in block 4 was completed earlier this year (April, 2020). It was expected that drilling of the 2nd well in block 9, would happen before May 2021. However, and prior to the blast, Total was already considering postponing drilling in Block 9. The far reaching impacts of COVID, have already forced Total to postpone exploration plans in Cyprus.for an entire year. Prior to August the 4th explosion, Total was eyeing three options:

- Continue as planned and maintain commitment to carry out exploration drilling in Block 9 before May, 2021.

- Postpone drilling due to COVID 19 pandemic (as they have done in Cyprus), citing the pandemic as a force majeure event.

- Withdraw from their minimum work commitment, abandon drilling a well in Block 9 and pay the $40 Millions fine.

It is safe to assume that the Beirut port explosion has unfortunately eliminated the first option for Total.

What remains are the 2nd and 3rd options.

Going forward there are three factors that may affect Total's final decision:

- Global economic developments: The pandemic has had its toll on the global economy and the demand vs. supply balance. With the resulting sharp drop in oil prices during the past months due to supply exceeding demand, a number of oil majors including Total have found themselves obliged to reduce their overall exploration budget by***.

- Geopolitical dynamics: With Erdogan’s clear intentions to assert Turkey’s presence in the Eastmed, France is currently confronting its Nato ally and strengthening its presence in East Med countries, regardless of their current exploration prospects. Lebanon is definitely one such country. The challenge remains to strike the balance between geopolitical gains and investing in commercially viable blocks.

- Lebanon’s domestic challenges: Since 2018 Lebanon has been slipping into a catastrophic economic and financial crisis due to lack of political will to perform needed reforms .Such reforms are urgently needed to ensure that exploration activities will be executed without any delays or setbacks such as the ones experienced during the drilling of the first well (environmental permit delays). Additionally, the political crisis is exhibiting its venomous impact through giving more value and attention to estimates/educated guesses rather than actual drilling results. With the ruling political parties, heavily advocating for the oil and gas sector as one of its victorious achievements subsequently mismanaging expectations, more weight is being given by the State to estimates speculating the presence of oil or gas offshore than to real drilling results that up till this moment have given no indication to the presence of any commercially viable resource.

So what should Lebanon do to put the oil and gas sector development back on track?

The Lebanese State is betting on oil and gas as a savior, but it’s own negligence has led it to afflict harm on its nascent oil and gas sector. The financial model that LOGI in partnership with Kulluna Irada, Heinrich Boell Foundation Middle East, and Open Oil have developed confirms that oil and gas will not be our savior. As per the key findings of the financial model, if Lebanon discovers and develops a commercially viable medium sized oil and gas field similar in size to Cyprus’s Aphrodite Field (4.5TCF ), then Lebanon’s share of revenue would be around $1.7 billion in today’s money (assuming $6 per MMBTU through life of project in real terms). While a few billion dollars spread out over 30 years is negligible in comparison to the amount of funding needed to get Lebanon out of its economic crisis, the more important contribution of an O&G sector in Lebanon is that it could be, if well driven, an important contributor to Lebanon's economy first, through alleviating the cost of gas imports, second, through the development of an oil & gas related industry, if the reserves prove to be sufficient enough and are an important source of foreign currencies. Moreover, the sector itself remains to be crucial to sustain Lebanon’s role in the East Med geopolitical play.

This being said, if we want to develop a sound oil and gas sector then the only way to do that is through institutional reform.

We have a consortium made up of oil titans Total, ENI and Novatek, that have shown initial interest to cautiously invest in Lebanon despite its economic meltdown. The 2nd licensing round was originally launched by the Lebanese government last April 2019 and postponed till end of 2022 due to lack of interest from investors. It is very important now that Lebanon helps itself and supports the continuation of this sector through working on immediate changes in its governance system, that has so far been operating within a sectarian power sharing framework.

More specifically, Lebanon should encourage investors by reducing risk factors associated with systemic corruption, through:

- Working on strengthening public accountability and oversight through ratification of laws and policies such as public consultations law.

- Ensuring that access to information law is implemented across all public institutions.

- Implementation of beneficial ownership disclosure across all sectors to ensure that no politically exposed persons are ultimately benefiting from deals.

- Enact and enforce fiscal rules to credibly commit to fiscal sustainability in the future, for instance through ratification of a Fiscal Responsibility Act, including a fiscal council. Fiscal rules that reduce the overall debt burden, such as expenditure rules or (structural) balanced budget rules, can form the basis of a Fiscal Responsibility Act.

- Ensure that drilling next year remains on track through exploring alternative shipping routes that will guarantee the arrival of the needed equipment and logistical support on time. Total needs to urgently provide the Lebanese government with an updated exploration plan that clearly commits to a feasible time frame.

The catalyst to making all this reform cycle happen is going to be a political will committed to protecting this nascent sector. Is such a will present?

As of now, the political will to enact any reform in Lebanon is missing in action.

This op-ed was written by Kulluna Irada's Director of Public policies, Sibylle Rizk, and The Lebanese Oil and Gas Foundation's (LOGI) Managing Director, Diana Kaissy.