Oil and Gas Revenues Won’t Exceed 10% of Public Debt

June 26, 2020 | Oil and Gas | Managing Oil and Gas Resources | Focus Lebanese Petroleum Administartion

Lebanese Petroleum Administartion

It has long been clear to many experts and observers that Lebanon’s deep fiscal problems will not be solved by the nascent oil and gas sector. Now, there are numbers to lend to that argument.

The results of a study by leading financial analyst Open Oil found that the discovery of a large oil and gas field of 16 TCF, similar to the Leviathan field in Israel, would provide Lebanon with between $4.5 and $8 billion. This only amounts to between 6% and 10% of the public debt, assuming the reserves can be fully developed and a price of $6 MBTU can be sustained throughout the life of the project.

In a less ideal scenario, with the discovery of a medium-sized oil and gas file similar to Cyprus’s Aprhodite of 4.5 TCF, Lebanon’s share of the revenue would be between $1.2 billion and $2.3 billion. This represents 1.5% to 2.87% of the public debt, or a bit less than one year’s worth of debt servicing.

“Oil and Gas will not solve Lebanon’s current economic crisis. It should not be the main pillar of an economic rescue plan or strategy,” Open Oil said. Instead, potential revenues could become a pillar in Lebanon;s future economic growth by contributing to alleviating the country’s perennial power cuts by using domestically-produced gas. This is especially useful in the context of the country’s acute dollar shortage, as a domestic gas market would reduce the drain on foreign currency reserves. Lebanon;s energy sector currently bleeds around $2 billion per year, largely as a result of the cost of heavy fuel oil.

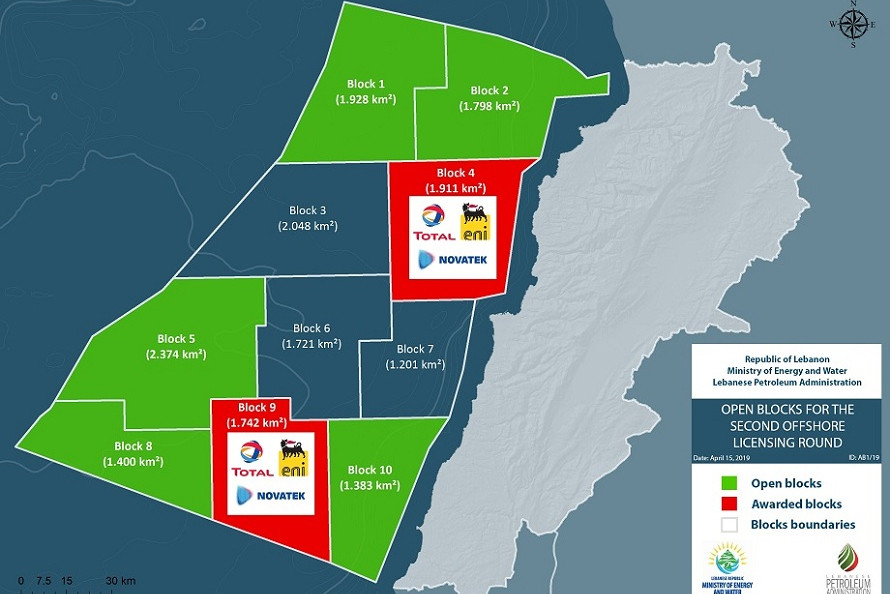

Open Oil found that the government’s take of 56% of oil and gas proceeds across Blocks 4 and 9 - according to the contracts signed with Total, Eni and Novatek - is fair and “falls in the middle of the curve of government take metrics for similar circumstances.”

Export gas or use domestically?

The crash in oil and gas prices related to the fallout of te COVID-19 pandemic has forced many nations to reconsider their oil and gas strategies, including Lebanon’s neighbor Cyprus in the East Med.

Lebanon is in a difficult situation as geopolitical conditions do not facilitate the creation of a pipeline to take its gas to Europe. At the same time, focusing solely on the domestic market could discourage international oil companies from taking part in bidding for two main reasons: less financial opportunity unless they can secure long-term price guarantees, and a lack of confidence in the bankrupt Lebanese state to make good on its commitments.

Even if it wants to use potential gas reserves for the domestic market, Lebanon first needs to build gas-run power plants and supporting infrastructure.

Despite Cabinet endorsing a plan which aims to create six new power plants in six years in May 2019, tenders for the projects have not yet been launched.

Read the full "Lebanon Oil and Gas Newsletter" for June 2020, published by Kulluna Irada and The Lebanese Oil and Gas Initiative (LOGI) here.